What Does Paul B Insurance Do?

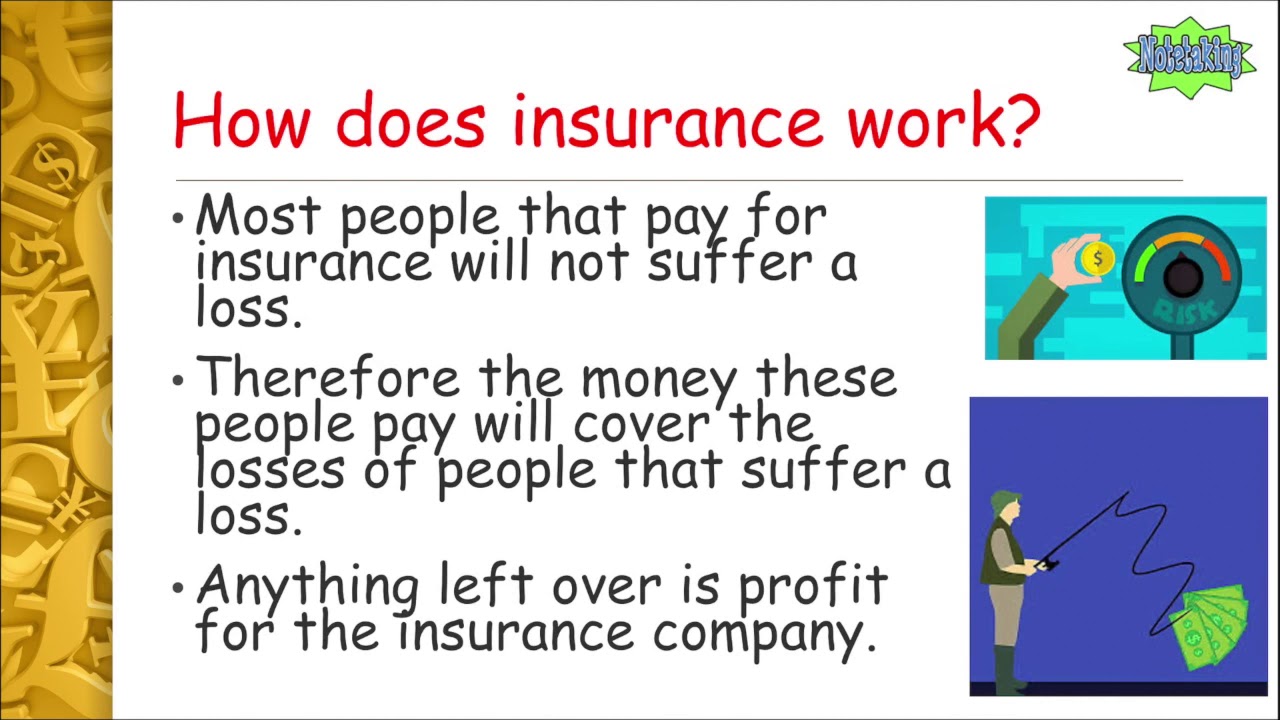

The thought is that the cash paid in cases gradually will certainly be much less than the complete premiums collected. You might seem like you're tossing cash gone if you never sue, however having piece of mind that you're covered in case you do suffer a substantial loss, can be worth its weight in gold.

Envision you pay $500 a year to insure your $200,000 residence. This means you've paid $5,000 for residence insurance policy.

Because insurance is based upon spreading the danger among many individuals, it is the pooled money of all individuals paying for it that permits the business to construct possessions and cover cases when they occur. Insurance is an organization. It would certainly be good for the firms to just leave prices at the exact same level all the time, the fact is that they have to make enough money to cover all the possible claims their insurance holders may make.

Not known Facts About Paul B Insurance

just how much they entered premiums, they should modify their rates to earn money. Underwriting modifications as well as price boosts or declines are based upon outcomes the insurance policy business had in previous years. Relying on what firm you acquire it from, you might be managing a restricted representative. They sell insurance policy from just one firm.

The frontline people you handle when you purchase your insurance policy are the useful source representatives and brokers that stand for the insurer. They will certainly get more discuss the kind this of items they have. The restricted agent is a rep of just one insurance company. They an acquainted with that business's products or offerings, yet can not speak in the direction of various other companies' plans, pricing, or product offerings.

Just how much risk or loss of cash can you think on your own? Do you have the money to cover your costs or financial obligations if you have a crash? Do you have special requirements in your life that call for extra coverage?

The Only Guide to Paul B Insurance

The insurance policy you require differs based upon where you go to in your life, what sort of properties you have, and also what your long term goals as well as duties are. That's why it is essential to put in the time to discuss what you want out of your plan with your representative.

If you get a car loan to buy an automobile, and then something occurs to the vehicle, void insurance will settle any section of your loan that typical automobile insurance policy doesn't cover. Some loan providers need their consumers to lug void insurance policy.

The primary function of life insurance coverage is to offer money for your recipients when you pass away. Depending on the type of policy you have, life insurance policy can cover: Natural fatalities.

The smart Trick of Paul B Insurance That Nobody is Talking About

Life insurance coverage covers the life of the insured individual. The policyholder, that can be a various individual or entity from the insured, pays costs to an insurance provider. In return, the insurance company pays out an amount of money to the recipients provided on the plan. Term life insurance coverage covers you for a time period selected at acquisition, such as 10, 20 or 30 years.

Term life is prominent since it supplies huge payouts at a reduced price than permanent life. There are some variations of common term life insurance coverage plans.

Permanent life insurance plans build cash money worth as they age. The cash money worth of whole life insurance coverage policies grows at a set price, while the cash money worth within universal policies can vary.

The Best Strategy To Use For Paul B Insurance

$500,000 of entire life insurance coverage for a healthy 30-year-old female expenses around $4,015 each year, on average. That exact same degree of protection with a 20-year term life plan would certainly set you back an average of concerning $188 annually, according to Quotacy, a broker agent company.

Nevertheless, those financial investments come with more danger. Variable life is another irreversible life insurance choice. It appears a lot like variable global life yet is actually different. It's an alternate to entire life with a set payout. Nevertheless, insurance holders can use investment subaccounts to grow the money worth of the policy.

Below are some life insurance policy basics to assist you much better recognize just how insurance coverage works. Costs are the payments you make to the insurance company. For term life plans, these cover the expense of your insurance policy and also management expenses. With a long-term plan, you'll likewise be able to pay cash right into a cash-value account.